Pensions & Investment Portfolios

Have you looked into your UK pension benefits recently?

Why we recommend a Self-Invested Personal Pension »

The personal pension is designed as a life-long plan and will continue to function through your retirement, under ‘income drawdown’; administering your pension income and lump sum benefits while the fund remains invested to promote capital growth and support income withdrawals.

- 100% passed to loved ones upon death rather than only 50% to a spouse in Final Salary schemes (Tax free pre age 75 yrs)

- Flexi Access Drawdown

- Regulated Investments

- 25% tax free Pension Commencement Lump Sum (PCLS)

- Multiple currency options available for both investments and income

- Early withdrawal in the event of serious illness

Defined Benefit Pensions

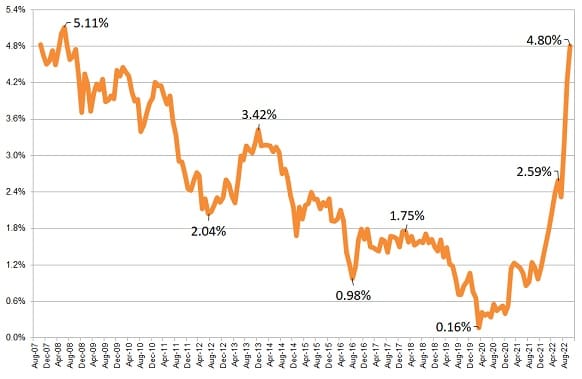

The last decade saw a huge number of people transfer out of their Final Salary Pension Scheme mainly as a response to soaring pension transfer values and death benefits for their families. However, with the recent volatility in financial markets caused by soaring inflation, interest rate hikes and increased bond yields, we have seen pension transfer values for Defined Benefit schemes start to fall. Final Salary Pension Transfer Values are closely linked to the value of Gilt Yields, as Gilt Yields go up, Transfer Values go down. Gilt Yields, linked to Interest Rates, have been sharply rising so many people have seen their Transfer Values drop significantly this year.

How is a final salary pension transfer value calculated?

A Final Salary Pension Transfer Value is the amount offered in exchange for converting from a fixed entitlement adjusted for inflation. You’ll be offered a lump sum which should represent a fair lump sum amount for the benefits you are giving up.

Your transfer value is decided by your pension scheme administrators and they’ll consider factors such as

- Your Age

- Scheme Retirement Age

- Cost of Living

- Life Expectancy of the average member

- Scheme investment costs & returns

As transfer values continue dropping, it’s worth finding out what your current transfer value is, so that you can consider transferring out.

The reason that Interest Rate rises are cited as being responsible for the fall in Transfer Values is that they have pushed up Gilt Yields, in turn, decreasing investment costs and increasing returns for most Defined Benefit Schemes. Interest rates have impacted Gilt Yields a traditionally low-risk investment that most Defined Benefit Pension Schemes are invested heavily in.

UK Final Salary Pension Transfer Specialist

If your pension transfer value is over £30,000 you’ll need advice from a Final Salary Pension Transfer Specialist in order to move it. As discussed we are partnered with a UK pension transfer specialist registered with the FCA to give advice on Defined Benefit Pensions.

A transfer specialist will be able to tell you if a pension transfer would be suitable for you based on your circumstances. In order to help you decide they’ll take a holistic view of your

- Current financial situation

- Future financialgoals & retirement plans

- Family & dependents

- Experience of

- Investing and your attitude towards risk

We will be able to provide an in-depth report to accompany any recommendation that you receive.

If you have any questions at all about your UK Defined Benefit pension, please do not hesitate to ask. Equally, if you would like a pension health check on your defined contribution pension(s) to check that the funds are performing well, in line with your risk profile and the fees and charges are reasonable, please send me a message or book a meeting with me.